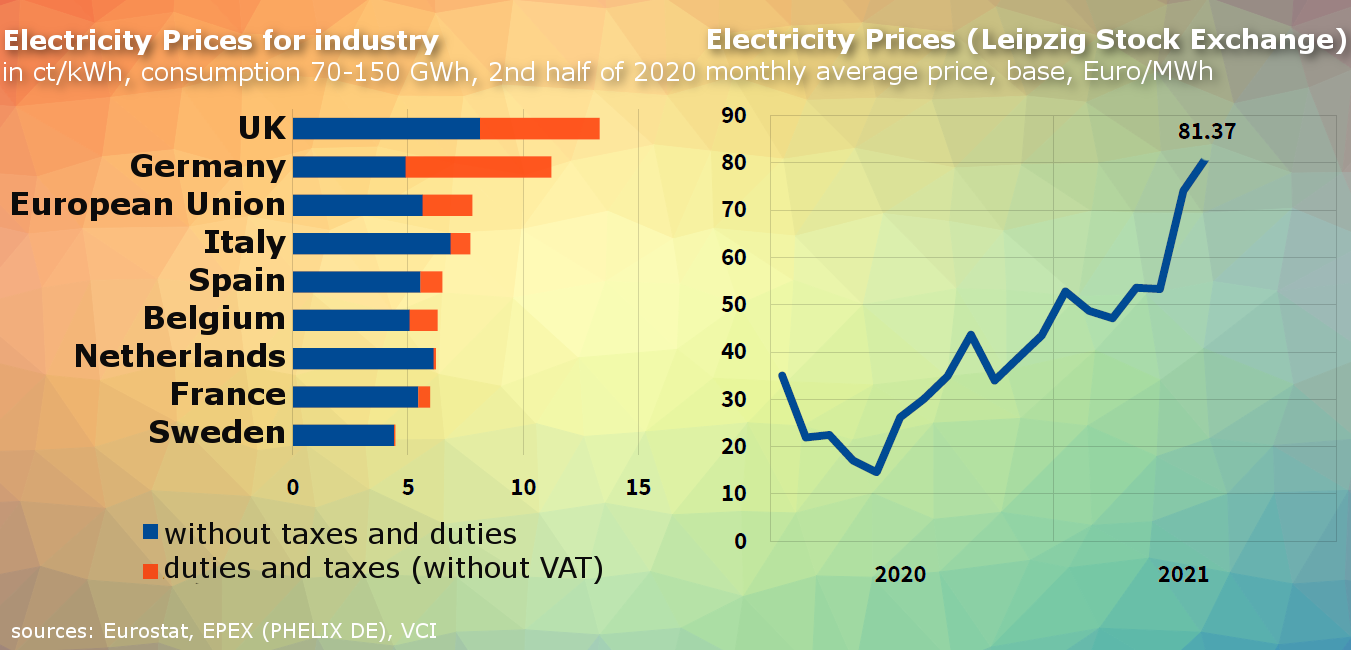

Despite the coronavirus pandemic and supply chain issues, the chemical-pharmaceutical industry had a strong first half of 2021 and for the year, production is expected to increase by +4.5 % and sales by +11 %. VCI President Christian Kullmann (Chairman of the Executive Board of Evonik Industries AG) announced these encouraging data at the VCI half-year press conference (see Fig. 1).

The greatest challenge for the industry is the transformation to climate neutrality by 2045. This epoch-making challenge, which they want to achieve even though the sector has already reduced its emissions by more than half since 1990, will demand an innovative, forward-looking approach. For this to succeed, the VCI is calling on the upcoming German government to reduce bureaucracy, cut state-related levies on electricity prices, and set up a state fund for the future that should give companies planning security for their investment decisions. In this context, the VCI takes a critical view of the EU’s “Chemicals Strategy for Sustainability”, which places further hurdles in the way of the EU’s fourth-largest industry without adding more value for the environment and the health of the citizens as REACH and other current regulations are doing.

Figure 1. Press conference of the VCI in Frankfurt am Main, Germany.

Strong First Half of 2021

Sales in the chemical-pharmaceutical industry rose by +12 % to €111 billion compared with the same period last year. This was due to a +4.7 % increase in demand in Germany and abroad, as well as a sharp rise in prices for chemical-pharmaceutical products. These rose at the fastest rate for ten years. Domestic sales were +12.4 % and foreign sales +11.8 % higher than a year earlier. The number of employees remained unchanged at 464,400.

As industrial production worldwide continued its recovery, demand for chemicals developed dynamically. As a result, Germany’s third-largest industry sector expanded its output by +5.9 % from January to June 2021. Plant capacity utilization rose to over 86 %, well above the usual level for the industry. This means that one in five companies is reaching its capacity limits in terms of production.

Nearly all the industry’s product areas benefited from the upturn in the first half of 2021, with the production of polymers up 20.3 %, fine and specialty chemicals up 8.7 %, petrochemicals up 6.9 %, inorganic basic chemicals up 6.3 %, and pharmaceuticals up 1.4 %. Only chemical products for consumption, such as soaps, detergents, and cleaning agents, recorded a decline in volumes of –1.8 %.

Very Good Forecast for 2021

The VCI expects that bottlenecks in precursors and disruptions in international supply chains will limit production possibilities. Nevertheless, the industry remains confident for the second half of the year due to the large surplus demand from its customers. The VCI expects production to increase by +4.5 % (chemicals +5.0 %, pharmaceuticals +4.0 %) and sales to grow by +11 %. The industry is expected to significantly exceed pre-crisis levels with record sales.

The VCI also expects a record figure for companies’ domestic investments. To make up for postponed projects from the previous year and expand capacities, the chemical association expects capital expenditure on property, plant, and equipment to increase from €8.4 billion to just under €9 billion in 2021.

Better Competitive Conditions Expected from New Government

The election for the 20th German Bundestag will take place on September 26, 2021. Christian Kullmann explains that all parties of the democratic center in principle agree that Germany needs measures to improve its competitiveness and innovative capacity quickly, unbureaucratically, and sustainably. He demands that politics give new freedom instead of further restricting and creating additional bureaucracy. Only in this way, the VCI is sure, can companies manage the transformation to climate neutrality by 2045. This is absolutely necessary to secure jobs and prosperity in Germany, he says.

In a survey conducted by the VCI, more than half of the association’s member companies rated the high costs (taxes, levies, construction costs) at the site (58 %) and the slow approval processes (51 %) as the most serious obstacles to their investments. In third and fourth place are high energy costs (47 %) and a lack of planning certainty (39 %).

To ensure that Germany remains an internationally competitive chemical and pharmaceutical location, the VCI is calling for changes in ten policy areas:

- Make energy greener and cheaper

- Promote innovation and progress

- Reform approval procedures

- Strengthen SMEs through less bureaucracy

- Strengthen the pharmaceutical industry

- Using the Green Deal and the EU’s chemicals strategy as an opportunity

- Expanding digitization and improving infrastructure

- Securing food with modern agriculture

- Advocate free trade

- Create better opportunities in tax competition

Lower Electricity Prices

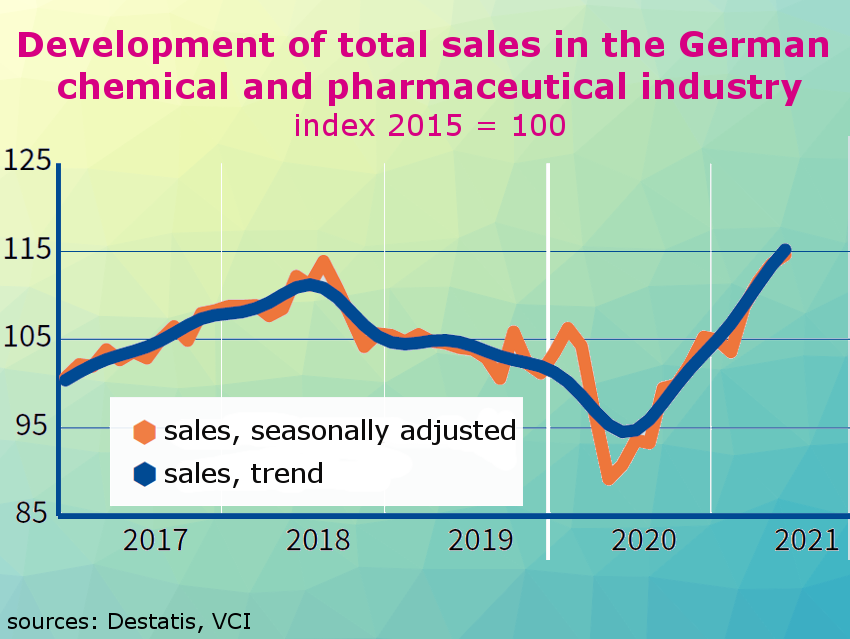

The price of electricity is particularly important for the energy-intensive industry. The price of electricity on the German stock exchange has risen sharply due to higher fuel prices, but above all due to a higher CO2 price in EU emissions trading (see Fig. 2). Electricity currently costs companies in Germany three times as much as in the previous year. This is hitting German SMEs particularly hard.

The VCI is calling for the upcoming German government to review all government-related levies on the price of electricity and cut them back as far as possible. The reduction in the EEG levy agreed for 2022 can, at best, be a start in the VCI’s opinion. The EEG levy is used to finance the expansion of renewable energies in Germany and is stipulated in the Renewable Energy Sources Act (EEG). All electricity consumers pay the EEG levy via a share of their electricity procurement costs; exemptions apply to electricity-intensive industries. The VCI president believes that an electricity price of 4 Eurocents per kilowatt-hour is necessary for the industry to successfully implement new climate-neutral technologies.

Figure 2. Electricity prices.

Planning Security Instead of Subsidies According to Cash Situation

The VCI also proposes to set up a state fund for the future to promote the transformation of industry and an eco-social market economy. It should have a total financial volume of 300 to 500 billion euros by 2030. It should only be used to fund projects in the following areas:

- To support the expansion of renewable energies and the necessary grid infrastructure, as well as energy storage systems

- To support the ecological transformation of the economy toward climate neutrality

- To ensure a modern and efficient transport and digital infrastructure

The association believes it is important that companies receive planning security for their investment decisions in the green transformation and not subsidies according to the cash situation at any given time. Such a fund would make planning security possible.

EU Chemicals Strategy for Sustainability Criticized

The VCI president voiced clear criticism of the EU Commission’s plans for a “chemicals strategy for sustainability.” This plan, which is part of the Green Deal, no longer bases a ban for a substance on scientifically proven risks, but on a theoretical hazard potential. The approach envisages a general ban on certain substances without risk assessment and public consultation. The EU’s existing regulatory framework for chemical substances and products is recognized to be among the most comprehensive and safest protection standards in the world. It is based on the world’s most advanced knowledge base. The VCI believes that this must not be compromised.

The EU chemicals strategy could ban thousands of substances from the European market in one fell swoop. This would have serious economic consequences for the chemical and pharmaceutical industries and the Green Deal according to the VCI. Many of these substances such as those used in semiconductors and chips essential for e-mobility, intelligent control of power grids, or wind and solar power plants are necessary for the transformation of the next decades and will become even more important in the future.

The European Commission published the “Chemicals Strategy for Sustainability” in October 2020. Part of the background is that Europe was the second-largest chemicals producer in 2018. Chemicals production is the fourth largest industry in the EU, directly employing around 1.2 million people. 59 % of production goes directly to other sectors, including healthcare and construction, as well as automotive, electronics, and textiles. Global chemical production will likely double by 2030 and the number of chemicals in many products will increase.

In the view of the VCI, only a strong chemical industry can ensure the path to climate neutrality and the resilience of the EU against future crises. To keep innovation, production of sustainable products, and value creation in Europe and bring back important production to the EU, the VCI believes that even some substances classified as hazardous are necessary. Sustainability and hazardous substances are not mutually exclusive. The safe and sustainable use of classified substances must be strengthened, while specific unacceptable risks must be identified and excluded.

- Verband der Chemischen Industrie e.V. (VCI), Frankfurt am Main, Germany

- Contribution from VCI to the Commission consultation: Roadmap Chemicals Strategy for Sustainability, VCI June 2020.

Also of Interest

- Chemical Industry Creates Platform to Achieve Ambitious Climate Targets,

ChemistryViews 2021.

Interview with Jenna Juliane Schulte and Manfred Ritz of the German Chemical Industry Association (VCI)

https://doi.org/10.1002/chemv.202100052 - The New EU Chemicals Strategy,

ChemistryViews 2021.

Expert discussions at the Helsinki Chemicals Forum included the Green Deal and the EU Chemicals Strategy

https://doi.org/10.1002/chemv.202100040

.PNG)