Chemical plant closures in Europe have risen sixfold since 2022, totaling 37 Mt of lost capacity, or around 9% of the continent’s production, and eliminating 20,000 direct jobs in the chemical industry, according to the European Chemical Closures & Investments Radar 2022–2025 by Roland Berger for Cefic. In addition, an estimated 89,000 indirect jobs are at risk across Europe, reflecting the chemical industry’s central role in regional value chains.

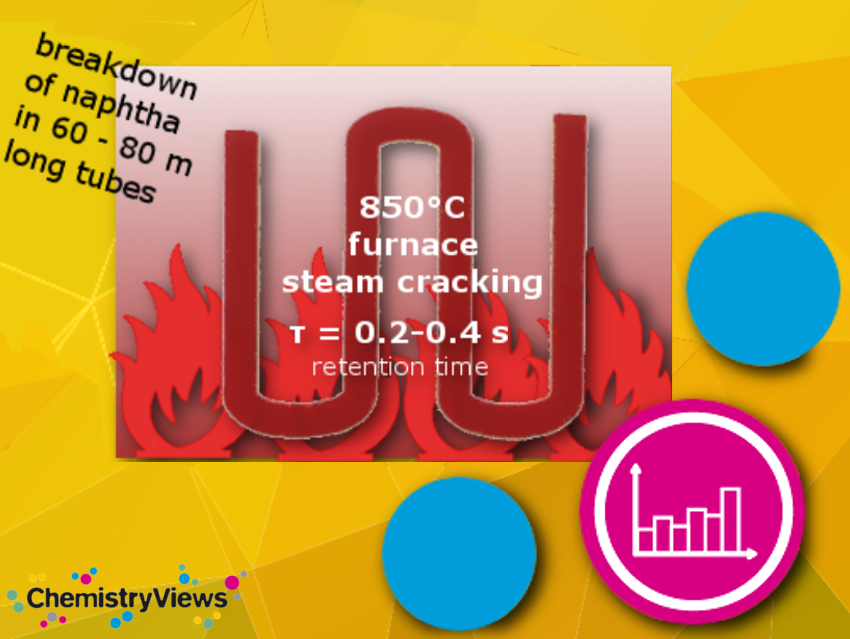

In terms of announced capacity closures, the petrochemical segment stands out at 48% of the total. About half of this is due to the announced closure of nine steam crackers. While closures are announced across Europe, Germany (25%) and the Netherlands (20%) account for ~45% of the capacity announced for closure. Lack of energy cost competitiveness is the main reason for closures. The other main reasons cited are low demand (19%), overcapacity (9%), and regulations (8%).

New investment has slowed dramatically. Annual announced investment capacity fell from 2.7 Mt in 2022 to just 0.3 Mt year-to-date in 2025, amounting to approximately 7 Mt in total over 2022–2025. This drop reflects a shift from broad investment across multiple innovation pathways, like electrification, hydrogen feedstocks, and circular plastics, to barely one pilot initiative.

With closures now significantly outpacing new investments, the European chemical industry is contracting. This trend raises serious questions about Europe’s ability to maintain a competitive, resilient industrial base.

- Roland Berger, Chemical plant closures rate surges six-fold in Europe since 2022, new report finds, Cefic, Brussels, Belgium 28 January 2026

Also of Interest

Learn from this picture how a steamcracker works