Yesterday, the German Chemical Industry Association (VCI, Verband der Chemischen Industrie) held its annual press evening on the chemical economy—for the first time as an online event. Dr. Wolfgang Große Entrup, Chief Executive Officer of the VCI, reported on the economic situation of the chemical and pharmaceutical industry in Germany. He gave an outlook for 2021 and explained what the industry believes is politically necessary to secure the future of Germany as a chemical and industrial location.

Economic Situation in 2020

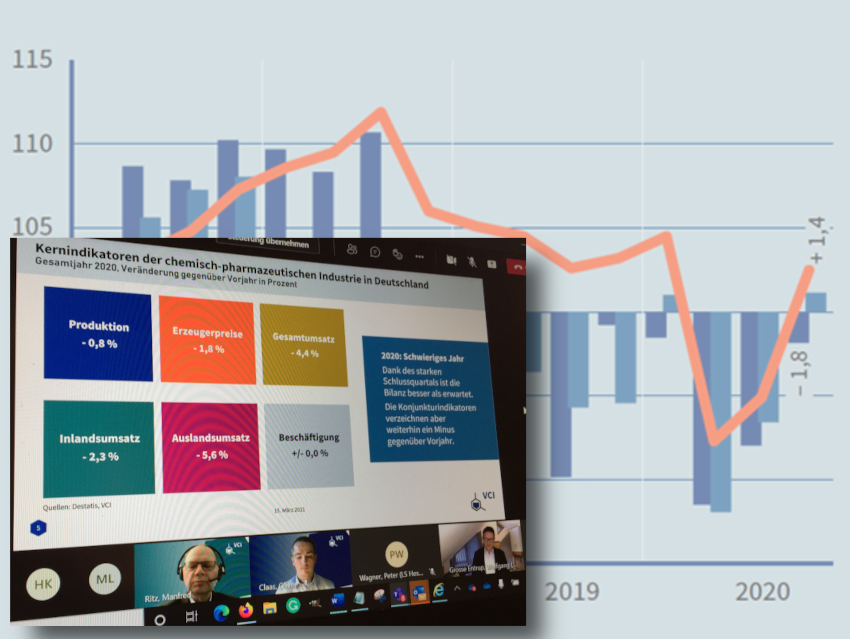

Economic output in Europe declined slightly in the fourth quarter, mostly affecting the service sector. For the fourth quarter of 2020, the chemical and pharmaceutical industry developed as follows: Sales increased by 8.1 % compared to the previous quarter (sales in Germany and abroad behaved equally dynamically), and production increased by 7.4 % (excluding pharmaceuticals, it increased by 9.2 %). Employment remained stable.

As a result, the numbers for 2020 as a whole are slightly better than had been expected in December 2020—the balance sheet shrank by just 0.8 %. The coronavirus pandemic left its mark on all chemical sectors: Production of petrochemicals rose slightly by 1.4 %, inorganic basic chemicals fell by 4.1 %, polymers by 3.1 %, fine and specialty chemicals by 2.1 %, and cosmetics by 1.8 %. Pharmaceutical production remained almost stable at –0.2 % in 2020.

Companies have prepared well for the pandemic with hygiene and safety concepts and coped well with the crisis overall. Nevertheless, operational disruptions have increased significantly, leading to supply chain disruptions. Some suppliers, especially abroad, have reported production problems or even force majeure. This mainly affects the plastics sector, but also components for steel and electronics. Logistics under pandemic conditions are very complex, with long delivery times, high transport costs, and additional border controls. Relationships with suppliers and customers suffer due to the lack of business travel opportunities. Joint development projects for customer-specific solutions only take place to a reduced extent, the acquisition of new customers is severely limited, and customer loyalty suffers as a result. Virtual opportunities are not considered sufficient.

Outlook for 2021

Despite good figures for the final quarter, the prolonged lockdown will not leave the industry unscathed. Around 50 % of the member companies of the VCI expect a damper. Chemical demand will be dampened by lower demand in other industrial sectors, such as the automotive industry. In addition, the continued dynamic situation in Europe caused by the pandemic poses considerable risks to the further recovery of the economy in the absence of an EU strategy.

Still, optimism is growing among VCI member companies that the pandemic will be overcome in the current year. For the full year of 2021, the majority of the chemical and pharmaceutical companies expect sales growth. At the moment, the VCI assumes that the chemical and pharmaceutical industry will grow by 3 %. Prices are expected to rise by 2 % as a result of increased demand. Overall, the association expects an increase in sector revenue of 5 %. For foreign business, the VCI expects a strong increase, mainly due to the high momentum in Asia.

Together Against the Coronavirus

With the social media campaign #AufDichKommtEsAn (“It all depends on you”), the VCI aims to thank employees in the industry who are maintaining local production under difficult conditions during the coronavirus crisis and are, thus, making a major contribution to overcoming the crisis by ensuring the supply of system-relevant products.

The “VCI-Notfallplattform (emergency platform) Corona” should also be mentioned in this context. The temporary site ensures that there is transparency among market participants about what is needed and what is available in terms of vaccination supplies. This is to ensure the supply of syringes, saline, etc., thus avoiding temporary shortages. Last year, very good experiences were already made with the emergency supply platform for disinfectants.

Political Preconditions in Germany

The pandemic has once again highlighted certain shortcomings of Germany as a business location: a large backlog in infrastructure investments in the public sector, delayed digitization in public authorities and schools, high energy costs, a complex bureaucracy, and a high tax burden on businesses. Wolfgang Große Entrup cites the example that, according to an analysis by the World Bank, Germany ranks 25th in terms of average Internet speed, putting it at the bottom of the list of industrialized nations. Of the 25 countries with the highest data speeds, 18 are in Europe.

The competitiveness of Germany as an industrial and chemical location is suffering as a result of these problems and increasing protectionism on global markets. “In the next legislative period, Germany must step on the gas with the necessary reforms,” said Wolfgang Große Entrup. “This year and this election will set the course for whether Germany remains a leading industrial country or withers more and more into an industrial museum.”

Central goals must include low electricity prices and the rapid expansion of renewable energies, as well as faster approval procedures and a stronger tailwind for innovations. Wolfgang Große Entrup concludes that mutual finger-pointing is anything but helpful in overcoming the crisis. Pandemic management and election campaigning do not go together. In Germany, a new government will be elected in September 2021. “Since we can’t suspend the pandemic, all that really remains is to suspend the election campaign. Pause it until 60 % are vaccinated. Living responsibility would be helpful for industry and citizens,” he says.

- Verband der Chemischen Industrie (VCI), Frankfurt, Germany