Bayer will have its annual general meeting (AGM) on Friday, April 26. Voting on the ratification of the actions of the Executive Board is one major focus of German AGMs. According to Reuters, sources say that BlackRock, Bayer’s largest shareholder owning 7.2 % of the voting rights, will either abstain from or vote against ratifying the management board’s actions. Bayer’s next two biggest shareholders, Singapore state investor Temasek and Norway’s oil fund, did not comment on their voting intentions, as did the asset managers DWS and Union Investment. Asset manager Deka probably will vote against ratifying the management’s action.

The vote has no bearing on management’s liability but is regarded as an important indicator of the mood of the shareholders. Bayer’s management, led by CEO Werner Baumann, received 97 % approval at last year’s AGM, which took place shortly before the Monsanto takeover was completed for USD 63 billion.

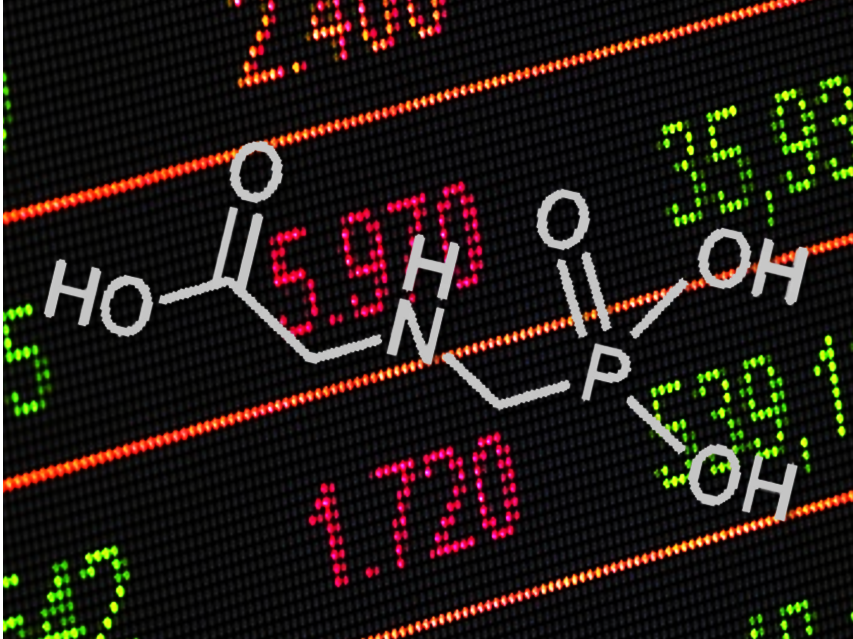

Bayer has taken over high risks with the Monsanto acquisition. In August, a US jury found Bayer liable because Monsanto had failed to warn of alleged cancer risks associated with glyphosate, the active ingredient in their weedkiller Roundup. Bayer suffered a similar defeat in a US courtroom last month, where many plaintiffs are claiming damages. The market value of Bayer decreased by around EUR 30 billion (USD 34 billion) since August 2019, according to Reuters.

The U.S. Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and other regulators have found that glyphosate is not likely carcinogenic to humans. The World Health Organization (WHO), in contrast, classifies it as probably carcinogenic to humans.

- Top shareholder won’t back Bayer management in AGM vote: sources,

Simon Jessop, Ludwig Burger,

Reuters April 23, 2019.